A Pan-African Payments Union

For a harmonious, continent-wide approach to the fading star that is the US dollar

The world is on the verge of a climate abyss, the UN has warned. Yesterday’s Guardian survey of climate scientists concluded that “the stakes could not be higher” and that scientists suffer “personal anguish at the lack of climate action” by world leaders.

Mohamed Adow, from Power Shift Africa, agrees:

It’s good to see the experts who follow climate most closely sharing their horror at the lack of action from governments. Those of us living in countries facing the worst effects of the climate crisis feel this too. My country of Kenya has faced its worst drought in 40 years and then last week saw hundreds killed in devastating floods. We wish leaders had the same sense of urgency as the climate scientists.

Climate change does not recognise Africa’s boundaries.

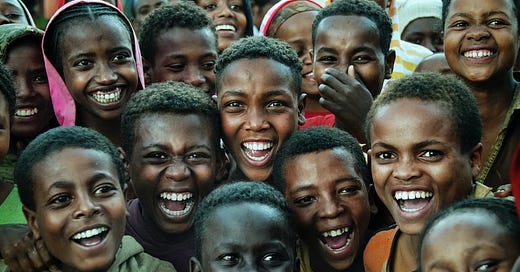

To ensure that Africa’s children have a future, its leaders could unite behind a harmonious, continent-wide trading and payments system that will help countries share investment, projects and innovation for tackling the climate crisis. A system that will unite the continent while respecting the political and economic autonomy of Africa’s 55 states. A system that will help build social, political and ecological resilience for future generations.

An African Payments Union (APU).

We’re half-way there

This may sound a radical proposition given the climate crisis, and the political, economic, and cultural differences of the great continent that is Africa. However, as Professor Massimo Amato (of Bocconi university) and Lucio Gobbi of Trento university argue (in an unpublished paper)

The good news is that such a collaborative alternative is already in the process of construction at a regional level and is both technically and politically feasible. ..One such arrangement is M-Bridge, a payments infrastructure using blockchain technology and sponsored by the Bank for International Settlements (BIS).

In addition an African cross-border payments system already exists – the Pan-African Payment and Settlement System (PAPSS) – intended to support the African Continental Free Trade Area (AfCTA). The explicit goal of PAPSS is to enhance commercial integration between African states along the lines of the African Continental Free Trade Agreement AfCFTA.

Compared to inter-European trade, inter-African trade is currently well below its economic potential and the politically desirable level. ..PAPSS could help ensure inter-African trade becomes the trigger for a shift from low-valued-added sectors, towards a manufacture-based economy - just as happened in Europe under the European Payments Union, when the continent recovered from the devastation of World War ll.

These systems achieve three important goals: First, they are payment platforms. Second, they are liquidity-saving mechanisms (in the sense they reduce dependency on US dollars and Euros). Third they are financing tools for regional traders, individuals, firms, banks and states.

The United States of Africa

The continent has another great advantage.

The African Union, with headquarters based in Ethiopia, speaks with one voice at big international meetings such as that of the G20 (where it is a permanent member), the European Union, and the World Health Organisation.

Latin America in stark contrast, is divided. It is not represented as a bloc in these international forums.

In addition, Africa already has multiple regional trade blocs, including the Community of Sahel Saharan States (CENSAD), the Common Market for Eastern and Southern Africa (Comesa); the East African Community (EAC) and the Economic Community of West African states (ECOWAS).

The ECOWAS bloc is currently in turmoil with several countries breaking away, in part because of the region’s lack of monetary sovereignty and its dependence on the Banque de France and the Euro. As Isabella King notes in an article in the Harvard International Review on The CFA Franc and French Influence in West and Central Africa: the French monetary zone has limited the industrialization and economic development in the region, and discourages trade among African member states.

Africa, the US dollar & the vast financing challenge of de-carbonisation

Africa suffers unnecessarily from the actions of the world’s issuer of the global reserve currency. It’s net commodity exporters lost substantial value in 2022 mainly due to monetary policy tightening by the United States’s Federal Reserve. At the same time the continent is facing a range of sovereign debt crises – debt denominated in US dollars - that are set to become solvency, not liquidity crises in the near future.

By providing the framework of a multinational structure for clearing payments, the APU would enable and require African countries to make cross-border payments in their own currencies. The clearing process would change the ownership of reserves and permit exchange rates to increase or decrease within a given range and a set period, in response to changes in reserve levels, explains Jane D’Arista in her book, All Fall Down.

Thus the clearing mechanism would preserve the valid role of market forces in shaping currency values through trade and investment flows while ensuring that speculators would no longer dominate the process.

D’Arista goes further and suggests that a clearing mechanism like the APU could

also reintroduce Harry D. White’s Bretton Woods proposal to authorize open market operations at the international level as central banks do at the national level.. It would do so by permitting the new clearing agency to acquire government securities from its member countries to back additions to their reserve holdings or sell securities from its member countries to back additions to their reserve holdings or sell securities to reduce the backing for those holdings – actions that would directly influence the effects of changes in reserves on national market conditions.

When approved by a supermajority of its members, the APU could act as an international lender of last resort by ‘printing’ money as central banks do – a role the IMF cannot play given its dependence on taxpayer contributions.

Pie in the Sky?

Keynes thought of his proposal for an International Clearing Union as utopian. He did not believe that humanity had the capacity to overcome differences and unite behind a proposal for trade stability, harmony and peace. But in 1944 there was little awareness that the world could collapse into a “climate abyss” - one that threatens the very survival of human civilisation.

Today we cannot say we did not know.

Furthermore, as the BRICS debate on de-dollarisation has shown, geopolitical tectonic plates are shifting.

The US dollar’s fading star

Amato and Gobbi argue that despite appearances, the hegemony of the dollar has already begun to weaken. The fading of the dollar’s star brings to mind, they suggest, Thomas Mann’s comment in the novel The Buddenbrooks:

The outward signs, the visible, tangible ones, of fortune and ascent only manifest themselves when the downward parabola has actually begun. Those outward signs need time to come to us, like the light of one of the stars up there, of which we do not know whether it is about to go out or whether it is already extinguished when it shines at its brightest.

There was a time when the global monetary system based on the US dollar seemed eternal and unchanging. And sure enough, despite recurring crises, the dollar system, like a bright shining star, still illuminates global financial markets.

But we must not allow ourselves to be blinded by a light that no longer corresponds to the harmony of the world.

We must start to build viable and visible alternatives.

...and African Liberation Day is May 25th. Exhortations from past years from the likes of Kumi Naidoo include to:

- Stop the bleeding (of resources, money)

- Use day to amplify your own work *and*

- Read aloud the Kilimanjaro Declaration. Then

- stand up together and say "we are Africans, and we are rising for justice, peace and dignity."

- Catch it on film (and share it).

--> Maybe there us a way for you to support ALD with this analysis.

Beautiful and comprehensive summary