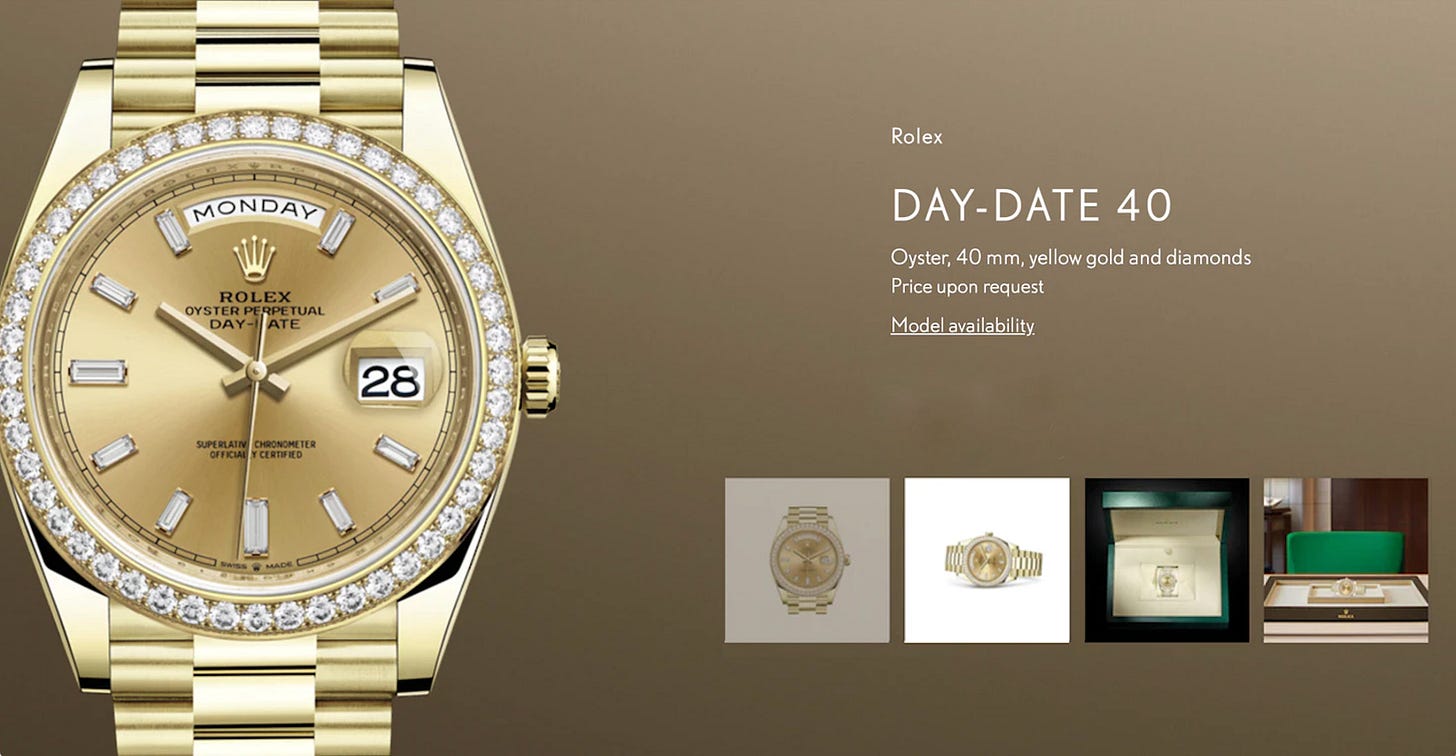

According to Wikipedia the cost of a Rolex can be as much as $6,500. But it can rise all the way up to $75,000 for one like the above, made with yellow gold and diamonds.

However, right now the price of a Rolex watch on ‘the secondary market’ is falling.

Why? Let’s take a quick dive.

The Rolex watch is an excellent buy for those in need of a ‘liquid asset’.

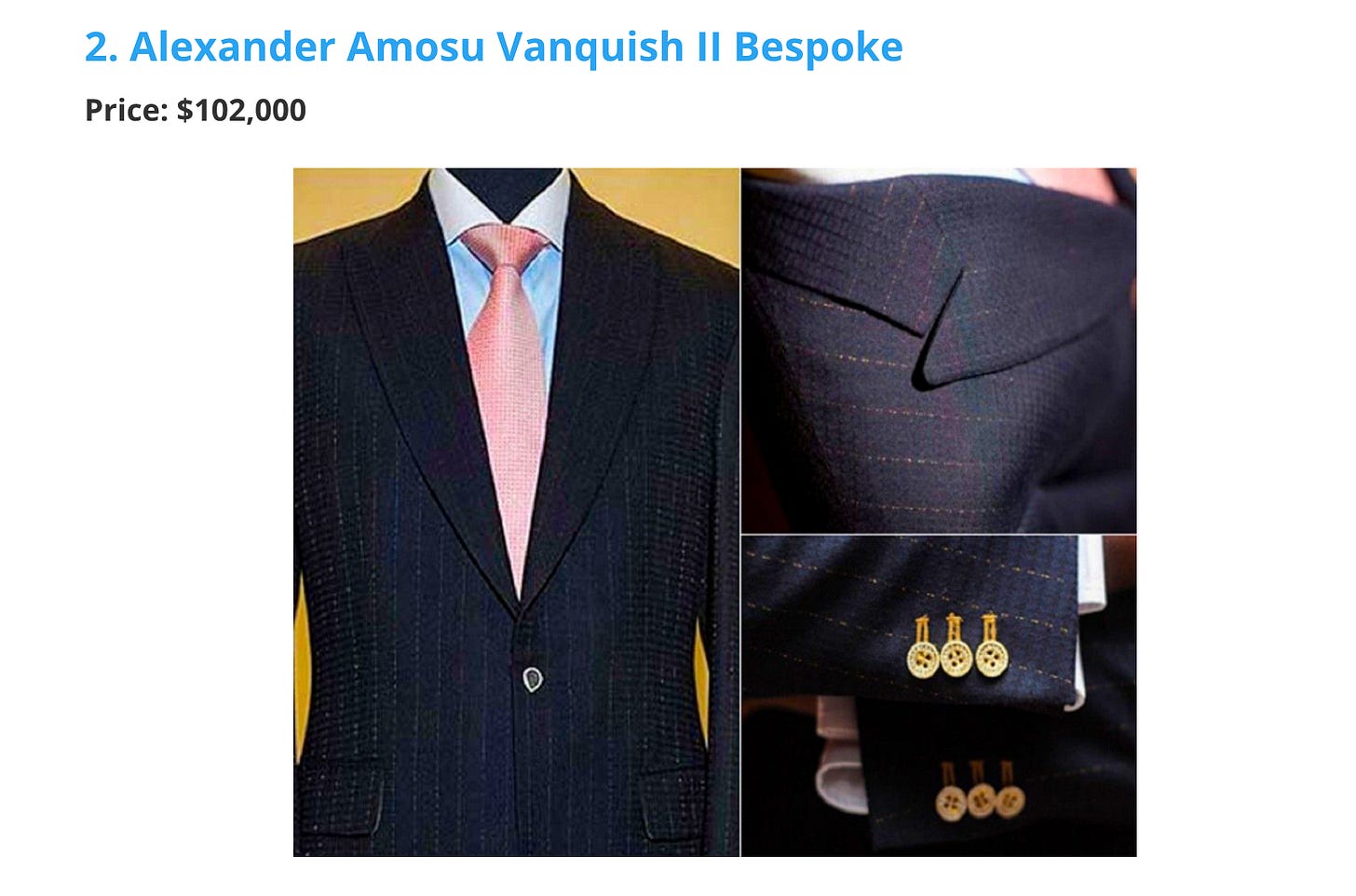

It is one that in a flash can be swapped for cash - if there’s a willing buyer. Alternatively it can be whipped across borders and exchanged for foreign currency. Its owner can make the cross-border dash discreetly, by lowering the cuff on his elegantly tailored suit, and hiding the financial asset as he passes through customs.

That way he safely moves his portable wealth away from the intrusive gaze of tax collectors and does so in a way that causes no alarm to customs officials or the central bank regulatory authority.

Once safely across the border the watch can be exchanged on the ‘black market’ (a term used for secondary markets in Rolex watches).

It is exchanged for much-needed and currently more valuable, cash.

Right now cash is more valuable because reserves of cash are diminishing, as Daniel H. Neilsen of the blog ‘Soon Parted’ notes. That is because central banks are raising interest rates.

Investors have piled trillions of borrowed dollars into financial and other assets. As interest rates rise, they seek to pay off their debts with money raised from asset sales. In other words, to avoid defaulting on that borrowing, they hope to flog off their asset to raise the cash to pay down the debt. But too many potential buyers have piled their available (i.e. liquid) cash into fixed assets, so cannot buy. And too many debtors share the same predicament as our seller. That is in part why cash is now more valuable than it was before.

Back to the central theme of this post.

The Rolex’s liquidity and its near-invisibility makes it an asset that can quickly be converted into money that has gotten a lot more valuable in the last few weeks.

It is therefore an asset much favoured by criminals, drug dealers, crypto bankrupts, corrupt government officials, and other dodgy characters.

Now prices of this asset are falling, Joe Weisenthal of Bloomberg reports.

Drug dealers/Russian émigrées /Bitcoin ‘investors’/Stable coin losers and others are dumping Rolex watches on a market where watches are now fetching a mere US$14,471 dollars?

They’re dumping this asset to realise gains in the form of ‘more valuable money’.

They are not alone.