This morning, in response to questioning by BBC journalists, the Bank of England governor was firm: the cause of high prices was well understood. Russia, “the world at large” and ‘the war in Ukraine’ were mentioned - and blamed - more than once for the inflation of energy and food prices. (Listen from 2h 10 mins onward)

But, as Bloomberg reports: (4th August, 2022)

Oil extended declines to the lowest in almost six months as weaker US gasoline demand and recessionary fears weighed on markets.

West Texas Intermediate fell 2.3% to $88.54 a barrel, a level last seen in the weeks leading up to Russia’s invasion of Ukraine.

The oil price is now below the level it was before Russia invaded Ukraine. Do we credit Russia for that fall? Has the war effectively ended - even though there has been no official announcement? Or is it that President Putin has undergone a Damascene conversion, and now regrets the pain he inflicted on the global economy by deliberately hiking oil prices?

None of the above.

On Twitter, Roger Diwan offers an expert’s explanation of the fall in prices:

Russian exports: therein lies the crucial clue. But wait:

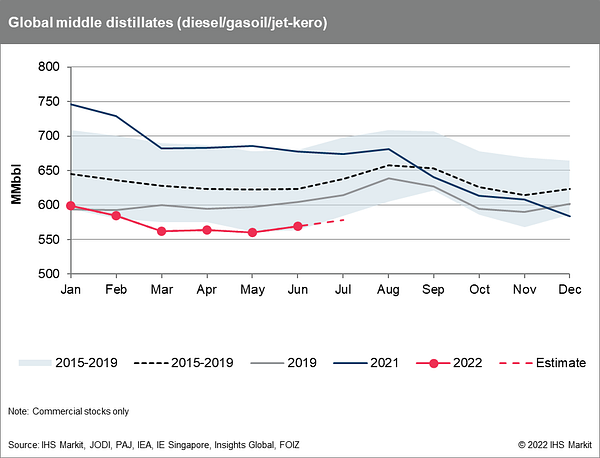

So if the Russian supply of oil did not change much, what did? Perhaps the fall is down to the build-up of a stock of oil inventories?

So we have “prices” (and refiners) to thank for the fall in prices?

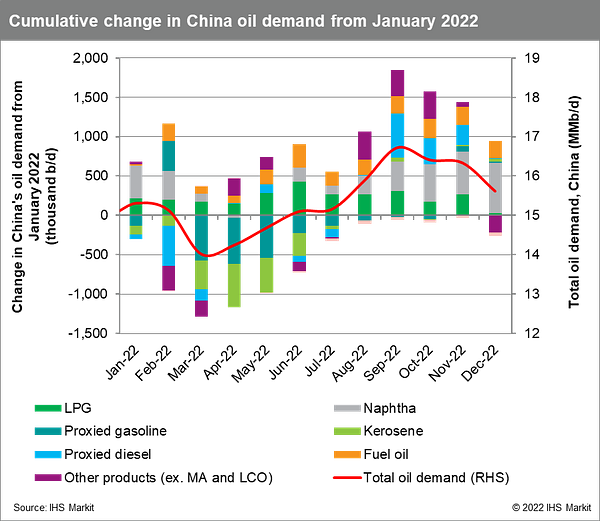

Perhaps it was the magic of supply and demand that lowered prices? Ah yes, the awesome power of demand…

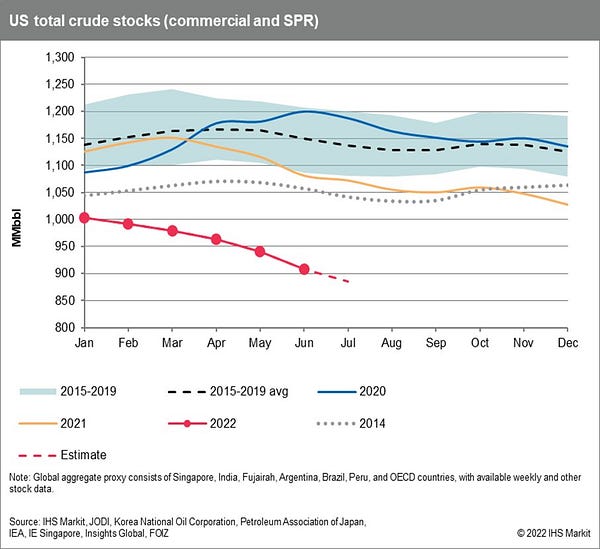

And then to add further ballast to his argument there was President Biden’s judicious drawdowns of US Strategic Oil Reserves (SPRs)……

Despite all this sensible reasoning, some are still stunned: Back to Bloomberg:

Prices falling below $90 a barrel “is quite remarkable given how tight the market remains and how little scope there is to relieve that,” said Craig Erlam, senior market analyst at Oanda. “But recession talk is getting louder and should it become reality, it will likely address some of the imbalance. Just not in the way we’d like.”

In the end, Bloomberg gives it to us straight: “war-driven gains” have been erased by the market in “crude futures”…..

Nutting whatever to do with supply and demand…Everything to do with speculation in the global, unregulated and speculative market for “crude futures”.

This is good, Ann. As we underestimated the role of the global financial system that took economies down in 2008, we continue to underestimate the role of financial markets in driving price on underlying assets!

Expectations expectations expectations