The Bank of England has inflicted the biggest rate rise in more than thirty years on millions of Britons already battling a succession of shocks, including the latest: a cost-of-living-crisis.

Technocrats at the Bank are not alone: European and American central bankers are engineering a worldwide slump, as the ex-Fed macroeconomist Claudia Sahm has powerfully argued.

These are the technocrats who have since 2008 used QE to deliberately inflate asset bubbles in the globalised and private, shadow banking sector. They have never publicly condemned, or constrained, asset price inflation (API).

Instead they are obsessed with consumer price inflation (CPI) - and ‘inflation targeting’.

That could be because the households of the rich complain bitterly if central bankers try to deflate an asset price bubble. So API is never a thing. Since the deregulation of the late 60s and 70s central bank policies have largely been aimed at sustaining the wealth of the 1%.

And tackling inflation caused by global commodity market speculation is hard. It would mean reining in speculators through internationally co-ordinated regulation and intervention.

No central bank is willing, or ideologically prepared to do that.

However, because CPI inflation erodes the value of debt, and involves a transfer of wealth from creditors (money-lenders) to the rest of the community - central bankers have as their central mission the slaying of the inflation dragon - or ‘inflation targeting’.

To appease creditors and slay inflation, they raise rates.

Higher rates harm borrowers - individuals, households, traders, manufacturers and farmers - anyone who finances the purchase of a home, or their business, with borrowed money.

Also, CPI is easier to track than API: the price of gas, food and mobile phones is easy to collect. And workers and their families are less likely to object to higher interest rates if the corporate media lead them to believe it will cut the inflation eroding their income.

With rigid steeliness the central bankers of Britain, the EU and the US are now imposing a form of monetary austerity on all those who work gainfully by hand or brain - in the domestic economy.

Here in Britain they are doing so in concert with a Conservative government that will soon abandon its electoral mandate to complement the Bank’s actions with a ‘double whammy’ of fiscal austerity.

Millions of workers - in the NHS, on the railways, and in postal services - whose income is plummeting as inflation erodes their spending power - will be hit the hardest by the Bank’s anti-inflation strategy.

So beware these false prophets, dressed in sheep’s clothing; they who are inwardly the ravenous wolves of biblical fame – and embarked on class war.

I plan to write more about civil servants that are central bankers - and their role in the world’s ongoing financial crises…. In the meantime this post’s focus is on the Bank of England.

Engineering a slump

Alongside the rate hike, and largely because this is the 8th hike in a year, bank technocrats are brazen enough to ‘forecast’ a recession as a consequence of their hike. They predict an increase of 6.5% in unemployment in the medium term, and, within two years, a sharp fall of inflation into effective deflation.

This is not just forecasting, but creating conditions that will lead, by their own admission, to company failures, a rise in mortgage defaults, bankruptcies, job losses – and unfathomable public anguish.

This is what Neal Hudson the housing specialist thinks will happen to UK mortgage rates:

Mortgage rates are due to rise to 6% and above. And here Neal Hudson shows how a borrower’s repayments on a higher loan-to-income mortgage will, in general, take 25% of her income - the highest share since the housing price crash of 1990.

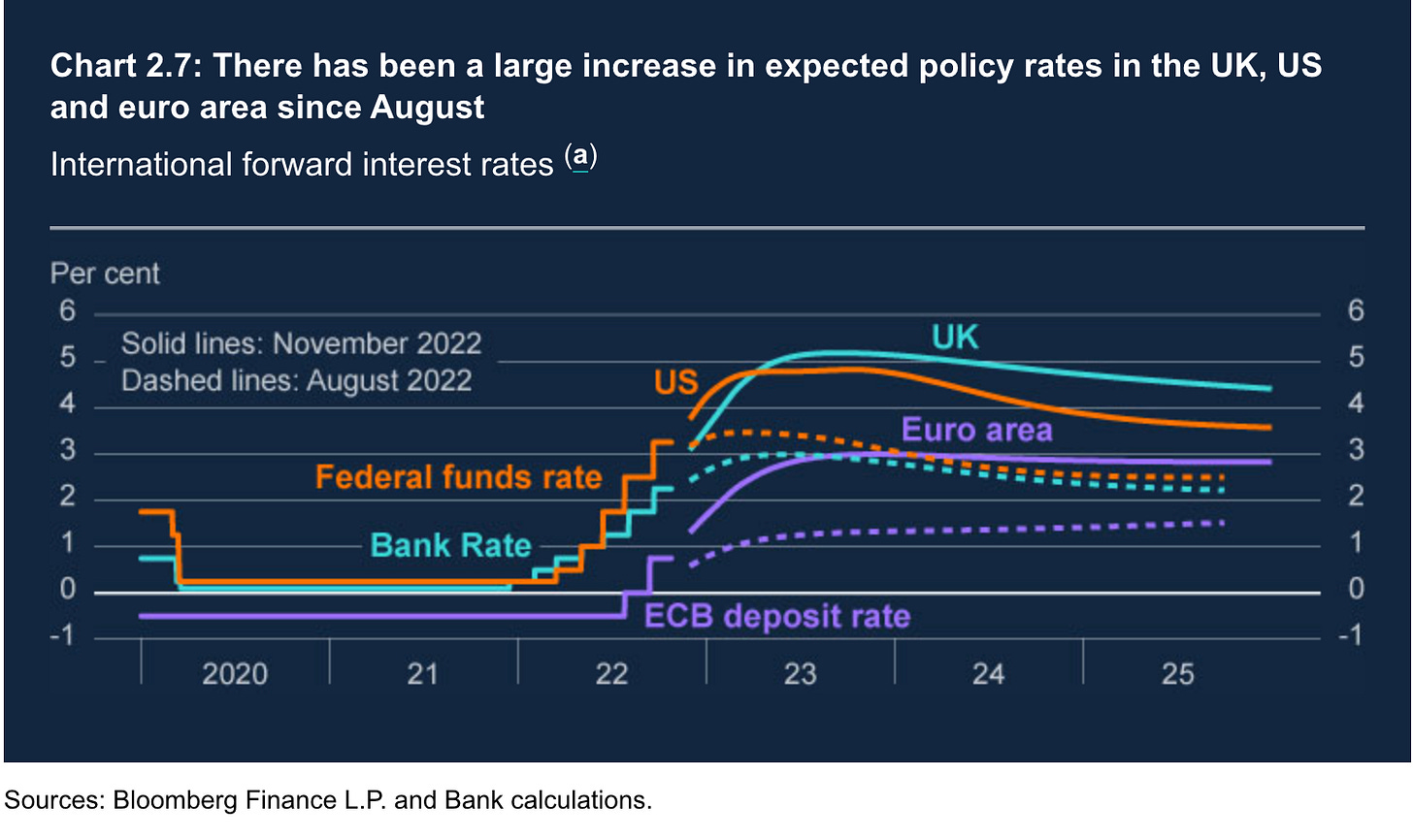

And this is not the end of rate rises. The Bank published the chart below showing that expectations of rising BoE rates are higher than for every other comparable central bank.

Yields (the rates or returns) on long-term UK government bonds (borrowing) are also amongst the highest in the world, thanks, in part to reckless government policies. The Bank’s monetary austerity is set to tighten the economic screw of the government’s expected fiscal austerity.

Economic failure will be the result.

These developments are an indictment not only of the wrecking ball that is Bank and Treasury economic ‘orthodoxy’: not only a charge against the libertarian Tufton St monetarists; but of the economics profession too.

On the day after the Bank’s decision, the consumer rights campaigner, Martin Lewis appeared on the BBC’s daily Radio 4 ‘Today’ programme and its 6 million listeners.

Asked for his views on the rate rise he said modestly:

I am not an economist. Just a consumer champion. Ask an economist to explain why the Bank of England is tackling a supply chain issue by crushing demand.

The supply chain issue

The supply chain issue is global: as well as bottlenecks in container shipping, it is the rise in energy and food prices. These were caused in part by the Russian invasion of Ukraine, but inflated by speculators in global derivatives, futures and options markets for commodities like oil, gas and wheat. As the governor of the Bank of England, Andrew Bailey remarked at his press conference the day before:

Wholesale gas prices continue to be exceptionally volatile. Spot prices have fallen recently…. But medium-term futures prices have been driven higher… The Committee has conditioned its November forecast on the full futures curve for wholesale energy and non-energy commodity prices.” (Emphasis added)

The technocrats at the Bank know that it is futile to use higher rates to tilt at the ‘windmills’ of global, speculative futures prices fuelling inflation worldwide.

So instead they are crushing demand.

Demand

Demand, an economic concept, can be defined as the willingness of those with available income, to spend that income. Demand - in contrast to the global supply chain issue - is home-grown.

For a British individual to have sufficient income to create ‘demand’ implies that individual has income-generating employment in either the private or public sectors, and low levels of debt. (British households had a debt-to-income ratio of 133% in the second quarter of 2022).

For a firm it means profits and dividends from sound business activity and low levels of corporate debt.

Income for both sectors is like to be ‘crushed’ by the Bank of England’s rate hikes, the consequent moves in (private) market rates of interest (no one in the non-financial sector pays the Bank rate on loans and debts); and by the predicted recession.

The Bank’s Monetary Policy Committee has chosen to shrink that share of the nation’s income left over after paying for high energy and food prices.

And those millions of workers - in the NHS, on the railways, and in postal services - whose income is plummeting as inflation erodes their spending power - will, as Martin Lewis argues, be hit the hardest.

By “crushing demand” the Bank staff expect at some point to succeed in bringing down inflation. But at a very high price: job losses, bankruptcies and home re-possessions.

The Bank has gone so far as to forecast deflation, as the chart above shows. Deflation - when the inflation rate becomes negative - is a symptom of generalised economic failure. It also involves, as Keynes argued (in A Tract on Monetary Reform):

a transference of wealth from the rest of the community to the rentier class and to all holders of titles to money [creditors]; just as inflation involves the opposite.

So the economic consequences of the Bank’s decision this week will be stark, as governor Andrew Bailey frankly admitted:

“The road ahead will be a tough one. ..The level of activity in our economy is likely to be flat, and even fall, for some time. ..

And then, as if determined to tighten the screw further, he concluded thus:

“Bank rate may have to go up further over the coming months."

This is what I wrote in reply to a piece in the FT today;

We have reached a tipping point, do you sense it?

There will be no more major QE, the Central Banks, or rather the interests that control them, do not want/need this. Instead, there will be more interest rate rises.

They have facilitated/created so much sovereign debt that it is no longer sustainable; the problem needs to be "dealt with."

They will tell us that the invisible hand of the market, is just prone to these slips- they are unpredictable and unavoidable- nobody was really responsible.

(That has been the exact problem; nobody has been responsible, every politician who should have done something has just rolled over and done what they were told to.)

The Central Banks, or rather those whose interests the CBs serve, or the political mouth pieces, through which they speak, will tell us that they have a solution- ( let's trust those unregulated forces that have caused this problem, to introduce the solution!) -Central Bank Digital Currencies- nice programmable money, where what funds we have can be constantly surveilled. Where what we spend it on, and in what time frame (before it expires) can be controlled.

This will not all happen at the point they suggest this "solution," of course, but it will happen, and more quickly than you will believe.

Caveat lector...

It is tremendously stupid that we give a single business model (Finance) a virtual monopoly to create the economic life's blood (money) of every individual and other commercial agent. But it is titanically stupid that we enable them a monopoly paradigm to create it ONLY as debt.

With that monopoly paradigm Finance has kept humanity on all fours for the entire history of civilization as Graeber and Hudson have well documented. And there's no conspiracy about it...because there's no need to conspire when you've been granted a monopoly paradigm which is the right to weield the power of the operant factor of an entire system/body of knowledge/pattern of thought. And unfortunately paradigms are like breathing, we're normally unconscious of them, and when you stack up 5000 years of acculturated unconsciousness it's no wonder even the most astute economists are unaware of the present monetary paradigm let alone be able to see the new concept that would beneficially and permanently change the entire character of money and economics.

It's past time we stood up on our own hind legs and demanded the monetary freedom that the last several centuries of our cultural inheritance of the ever increasing abundance of productive capabilities has bestowed upon us. A freedom that, all by itself, the present monetary and financial paradigm denies us.

And it's waaaay past time that we ended the bugaboo of inflation and the false orthodoxy that "inflation is always and everywhere a monetary phenomenon" by implementing beneficial price and asset deflation with a 50% Discount/Rebate policy at retail sale. That policy is powerful because it is the very expression of the new monetary and financial paradigm of Direct and Reciprocal Monetary Gifting.