Today’s international financial system is so designed as to grant immense power to civil servants at central banks. The purpose of the design is unequivocally clear, as I will show below: it is to de-democratize monetary policy - and in the process transfer wealth from the many to the 1%.

Over the last thirty years the design of the system as a whole has led to obscene levels of inequality worldwide, but also to financial instability and crises. Its current effects are most starkly evident in both the EU with the collapse of Credit Suisse in March, and in recent US events.

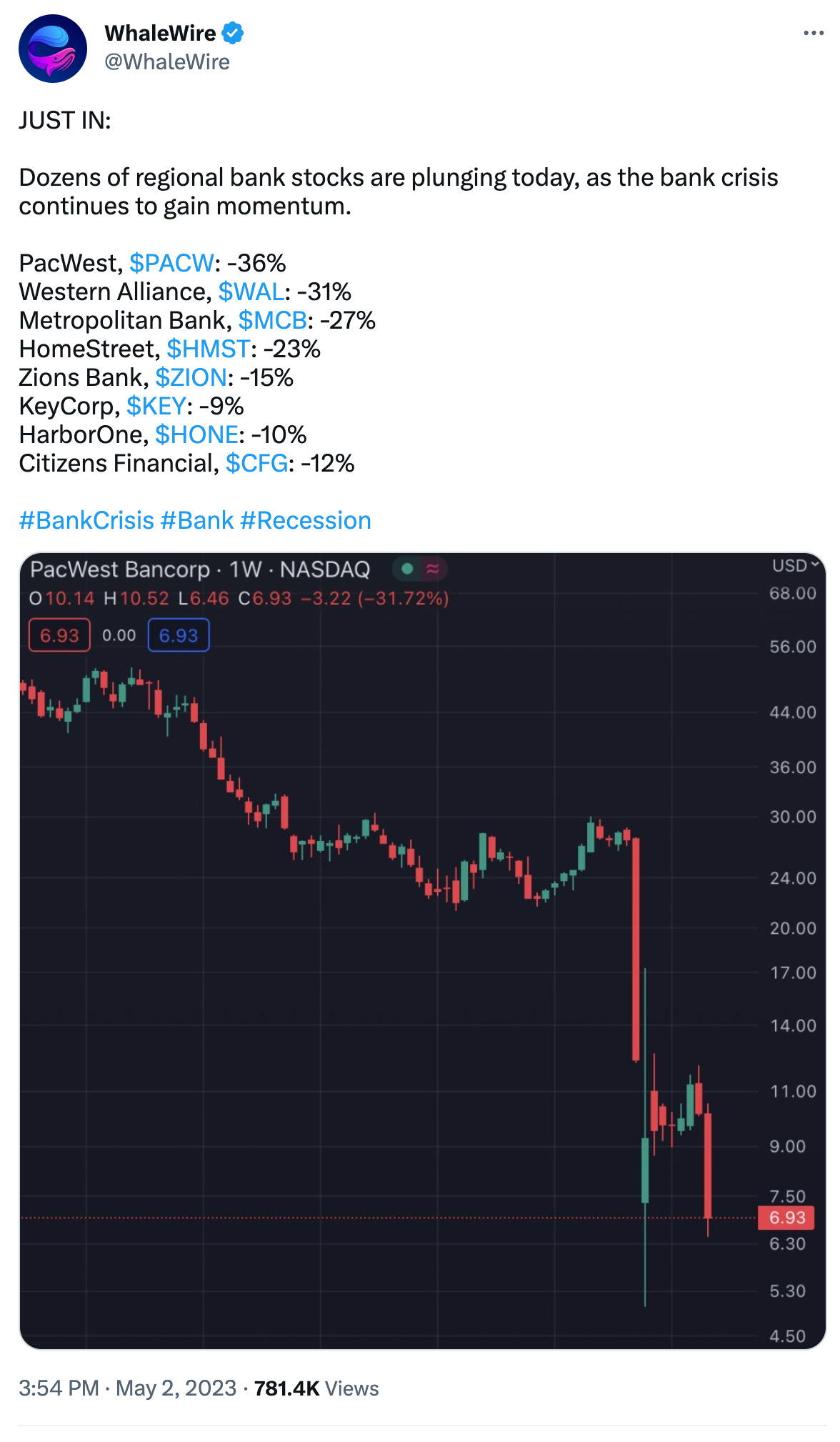

Rate hikes by the Federal Reserve over the last year compounded the pain of inflation and led to bank runs and failures. President Biden’s Inflation Reduction Act (IRA) has helped cut costs for American families, but done little to halt the financial instability caused by the Fed’s rate hikes.

And as Servaas Storm and Thomas Ferguson of INET argue in the Guardian:

Higher rates on loans have slowed borrowing for investment in transforming the economy away from its addiction to fossil fuels. They have led to defaults on debt, that have hurt firms and families. Bank failures, including that of First Republic - the second largest by assets to fail in US history - have in turn led to taxpayer-backed bailouts - and the consolidation of the wealth and power of too-big-to-fail Wall St. banks - notably JP Morgan, as the Financial Times reports:

With the state-orchestrated takeover of the failing First Republic (bank), JPMorgan has swelled to three times its size before the 2008 financial crisis, and now commands an asset base of nearly $4tn.

Partisan, political actions a consequence of CB ‘independence’

The premise that democratically elected politicians cannot be trusted to manage the economy but unelected and unaccountable bureaucrats can, has both been proven patently wrong by this recent experience, and, as the JP Morgan experience shows, is in itself partisan and ultimately political in its motivation.

Stefan Eich argues persuasively in The Currency of Politics that

… much of what passes as “depoliticization” would be more accurately described as the de-democratization of monetary politics, which itself ought to be subjected to democratic scrutiny. …attempts to “depoliticize” money rely on a performative contradiction - a magician’s sleight of hand - insofar as they disavow that such calls are themselves political moves within the politics of money. p. XV

The politics of money was most evident in the 1980s during the term of Federal Reserve chairman, Paul Volcker. As Christopher Leonard writes in The Lords of Easy Money Volcker’s policy of tackling inflation (caused, he argues, by the Fed’s ‘easy money’ policies) with rapid rate hikes benefited JP Morgan and other Wall St lenders, but led to the failure of many banks. Most worryingly the policy led to a run on the largest bank of all - Continental Illinois - the biggest commercial and industrial lender in the country. In 1984, after a succession of rate hikes, things fell apart when Continental’s oil loans defaulted.

Then, in a strikingly familiar tale…

New York’s J P Morgan pulled together a group of lenders to assemble a $4.5 billion line of credit for Continental, but that wasn’t enough. Continental’s customers lost faith in the bank and started a bank run, withdrawing about $10.8 billion in a year. …The FDIC estimated that 2,300 banks had money invested in Continental... The FDIC provided an extraordinary rescue package, injecting $1.5 billion into Continental… most important, the FDIC promised to cover bank losses above a previously set threshold of $100,000, protecting all bondholders and depositors.

This was a huge increase in the safety net for banks that invested money in Continental while knowing that the FDIC would only insure part of it.

Now all of it was insured by taxpayers. …

This history must scare US regional bankers facing falling stock prices, bank runs, the FDIC, and then capture by JP Morgan.

And what of the harms of inflation?

Inflation is damaging and must be tackled. Rather than using the blunt weapon of higher rates to depress the economy as a whole, I (and many others) want to see inflation tackled by regulating highly speculative, global markets in key commodities like energy and grain. And like Isabella M Weber and Evan Wasner, we believe that today’s ‘greedflation’ is

a sellers’ inflation that derives from microeconomic origins, namely the ability of firms with market power to hike prices…

…that hurt the poor struggling to pay for energy and food, while at the same time inflating corporate profits and remuneration, and protecting shareholder dividends.

Tackling inflation with rate hikes while refusing to take regulatory action to deal with spiralling food prices, rocketing profits and falling real wages - is blatantly political.

Insanity is Doing the Same Thing Over and Over again

The reason we are confident today’s central bank policy stance will both worsen inequality and will end badly - is simply because we have been here before: within living memory.

In the 1980s, Paul Volcker’s high rates policies led to catastrophic economic failure. According to the Federal Reserve’s History website: Both the 1980 and 1981-82 recessions were triggered by Volcker’s tight monetary policy, and

…the 1981-82 recession was the worst economic downturn in the United States since the Great Depression. Indeed, the nearly 11 percent unemployment rate reached late in 1982 remains the apex of the post-World War II era (Federal Reserve Bank of St. Louis). Unemployment during the 1981-82 recession was widespread, but manufacturing, construction, and the auto industries were particularly affected. Although goods producers accounted for only 30 percent of total employment at the time, they suffered 90 percent of job losses in 1982. Three-fourths of all job losses in the goods-producing sector were in manufacturing, and the residential construction industry and auto manufacturers ended the year with 22 percent and 24 percent unemployment, respectively (Urquhart and Hewson 1983, 4-7).

Paul Volcker’s career as chairman of the Fed did not end pleasantly, and he “was driven back into the wilderness” argues Leonard.

FOMC members cast dissenting votes against Volcker more often than at almost any chairman in modern Fed history. He asked not to be reappointed after his term ended in 1987. Volcker’s halo would only be bestowed in later years… p. 67.

Today central bankers in the US and Europe have not just revived and repeated Volcker’s failed policies, they hail them as the economic miracle that tamed inflation, and mimic Volcker’s errors with the fastest series of rate increases since the 1980s.

The impact on inflation after a year of rate hikes has been negligible. While headline US inflation has been falling consistently since last summer, thanks in part to the Biden administration, prices may have stalled in April. According to the BLS, the index for shelter was by far the largest contributor to the monthly all items increase. This more than offset a decline in the energy index, which decreased 3.5 percent over the month as all major energy component indexes declined. Analysts expect April’s “headline” and “core” inflation figures to rise by 0.4% month-over-month.

And as the Guardian writes, the Bank of England is confronting stark and uncomfortable facts. “Not since 1977 have British households faced food prices rising at a faster pace, while the headline rate of inflation is stuck above 10% – higher than in any other G7 nation.”

In Europe, the overall price growth in the 20 nations sharing the euro currency picked up to 7.0% in April from 6.9% a month earlier, according to Eurostat.

Ignoring the impact of earlier decisions when the Bank of England’s Monetary Policy Committee meet on Thursday, 11th May, members are likely to double down on the policy and turn the rates screw for the 12th consecutive time. As in the US, bankers paying roughly 0% on deposits, while charging higher rates on loans, are laughing all the way to the central bank.

However, while inflation is a worry, the much bigger worry is financial instability and another major “accident” reminiscent of the crisis at Continental Illinois in 1984 - leading to a severe recession.

There is more agony to come, folks, before central bankers are toppled from their orthodox thrones and sanity is regained.

·

If we'd make banking a public utility, eliminate 90% of speculative financializations and implement a 50% Discount/Rebate policy at retail sale utilizing the same method of money creation as the private banks use to create new money, namely equal debits and credits that sum to zero, we'd immediately turn erosive inflation into BENEFICIAL price and asset DEFLATION and mathematically double everyone's purchasing power all in one fell swoop. Open your mind, change the monetary paradigm and save your financial and economic security, stabilize the macro-economy and enable the kind of fiscal funding necessary to save the planet we all require to survive.

Thanks for this excellent summary. I have been going on about this for decades, without much success. BTW, Global Climate Compensation (www.global-climate-compensation.org/about) would be a way to re-democratize monetary policy whilst solving the Climate Crisis.