The Bank of England vs the People

Declaring war on the demos - with 'independence' as the shield

This is how misanthropes wage war. No, not Presidents Putin and Macron - although that particular war of words is alarming.

No this particular conflict is between an elected woman MP and a technocrat, a deputy governor of the Bank of England, Dave Ramsden.

Her name is Harriett Baldwin. She is a Conservative member of parliament, representing a marginal seat in Worcestershire, and fighting to retain the support of her electors. She is also the chairperson of a powerful parliamentary committee that scrutinises the Bank of England.

On the 7th February this year, Harriett Baldwin published an article in the Financial Times that was an undisguised attack on the Bank’s policies of Quantitative Tightening - or QT.

On the 27th February, the Bank of England fought back. Dave Ramsden, a deputy govwernor of the Bank, led the charge in a speech purportedly about bond trading and innovation - but in reality a sharp rebuttal to Ms Baldwin.

Dave Ramsden is a technocrat, unaccountable to British taxpayers that finance his salary. Unlike Harriett Baldwin he has never had to pose on a muddy path, alongside a bunch of farmers, as she campaigns for more farm support.

Before joining the Bank of England Dave Ramsden, as chief economist at the Treasury from 2007-2017, was responsible for implementing the British Conservative government’s draconian policies of austerity. If at least 26 local authorities are at risk of bankruptcy; if the NHS is buckling under the pressure of spending cuts to the incomes of nurses and doctors; if the criminal justice system is on its knees: if homelessness and rough sleeping is on the rise; if “rivers and the pollution affecting them is hampered by outdated, underfunded and inadequate monitoring regimes” - then Dave Ramsden, as ‘Lord High Executioner’ to George Osborne’s Chancellor - can be held partially responsible for austerity’s impact on these sectors. (For more on this see my 2017 post on PRIME: Those who helped break the economy cannot fix it.)

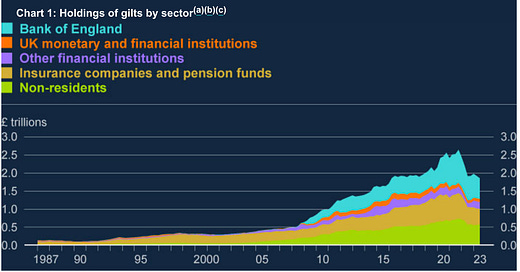

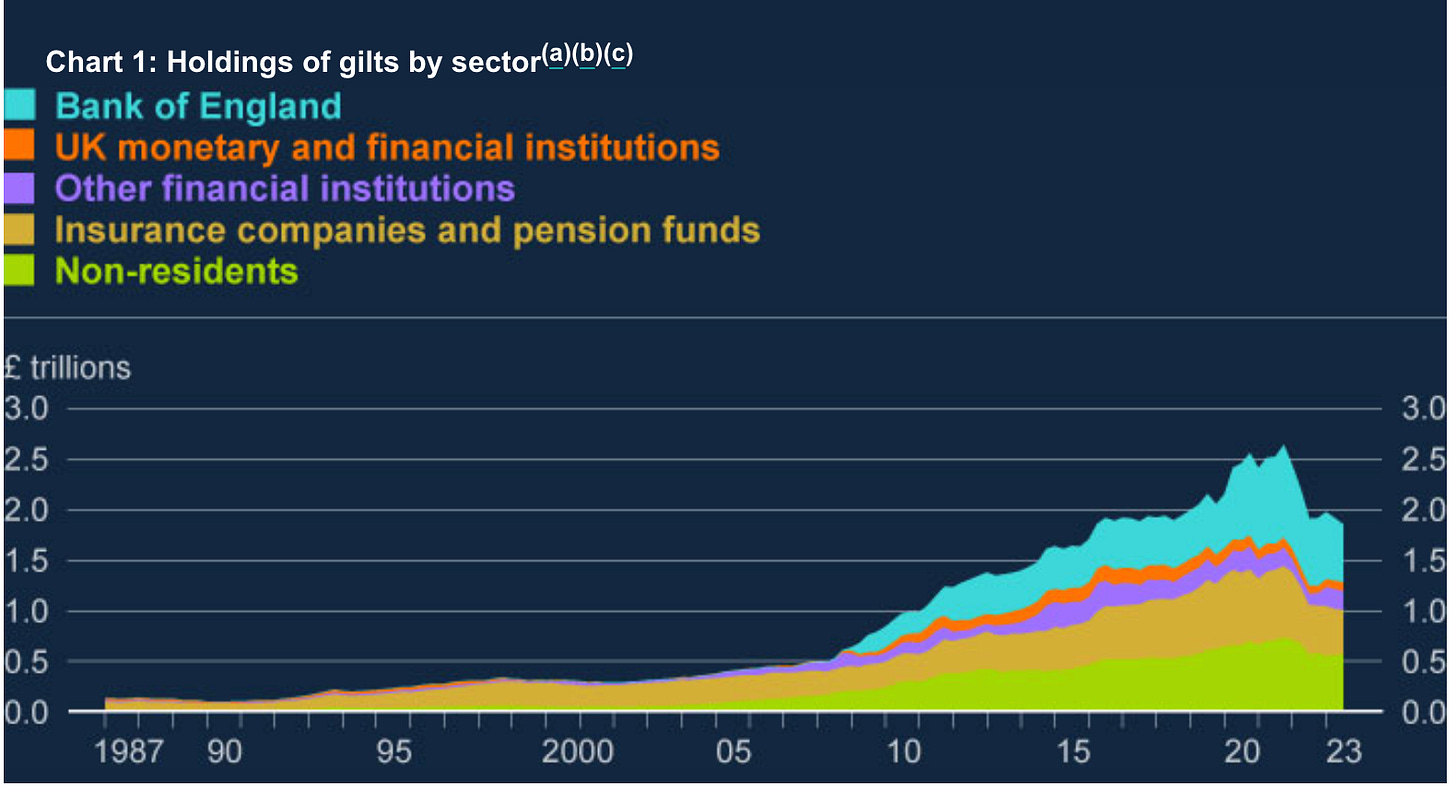

But Ramsden would have been influential in other ways too. I have little doubt that as chief economist at the Treasury he would have played a role in discussions with BoE governor Mervyn King - another austerity advocate - over the design of Quantitative Easing - known to insiders as the Asset Purchase Facility (APF). The chart above is from his speech on the 27th February, and shows the share of gilts (bonds) held by the BoE, compared to other financial institutions.

The amount of gilts held in the Bank’s Asset Purchase Facility (APF) on behalf of the Monetary Policy Committee reached a peak of £875 billion in early 2022 and has since fallen back to £735 billion. As a share of outstanding government debt, the share has fallen from 35% to 31%.

More on the APF below - because policy has changed. Today Dave Ramsden and the governor, Andrew Bailey, preside over Quantitative Tightening.

What is Quantitative Tightening?

QT is the reversal of QE.

Quantitative Easing was a name given to central bank policy which, after the GFC of 2007-9, launched the then unconventional purchase of government (sovereign) or corporate bonds (debt).

Government and the private sector were in urgent need of liquidity, to cope with an ecnomy that had been cratered by speculators on Wall St. and the City of London. Central banks obliged - by purchasing government bonds. That after all, is what they are there for.

By buying up bonds central bankers exchanged an asset (bond or gilt) for liquidity; and by doing so, increased the money supply.

On the other hand, by capturing and placing purchased bonds on their own balance sheets, central bankers removed sovereign and corporate bonds from the market-place.

The effect was to cause a shortage of bonds in capital markets, vital for use as ‘safe collateral’ by bankers and financiers wanting to raise additional finance. That shortage forced up the price of bonds, and because of the way in which the bond market works, lowered the interest rate on same bonds - which helped negative interest rates become more negative! (Don’t ask!)

That by the way, is how and why some people borrowed crazy money at negative rates, and benefitted richly from QE.

But I digress…

What’s QT and the APF got to do with Fiscal Policy?

The Bank of England paid for the purchase of those sovereign and corporate bonds with ‘high powered money’ which took the form of reserves deposited in commercial banks.

As Prof. Daniela Gabor explains here ( in an article titled: The Bank of England is Misusing Its Fiscal Powers) the BoE then typically paid :

interest on those new reserves to protect the effectiveness of monetary policy. When returns on bonds (held by the BoE) are higher than the interest paid on reserves, the central banks make a profit which is remitted to its local Treasury.

However, when central bankers like Governor Andrew Bailey, deliberately raise rates - above the level returned on the bonds purchased by his own central bank - then higher rates must be paid to private commercial banks. Those payments cause the Bank of England to make a loss on its bond purchases.

Most other central bankers decline to take losses, and adopt a relaxed approach to the rise in interest rates. They simply refuse to sell at the bonds’ lower price and higher rates. Instead they wait until the bonds mature - i.e. until over time, all the principal and interest on bonds on their balance sheet, has been fully repaid.

This is Ms Baldwin's major objection. “No major central bank has pursued QT” in the way the BoE is doing, she argues in the FT.

Both the Federal Reserve and the European Central Bank have opted only for the passive method of allowing their bonds to mature without replacement.

The Bank of England is throwing caution to the winds, she asserts, and adds.

The absence of supporting evidence on which the Treasury committee, or indeed the BoE, can predict the impact of its QT programme is why we concluded, this week, that the plans are a leap in the dark for the British economy.

Central bankers are meant to be conservative and risk-averse. They are not meant to take leaps in the dark. The Bank’s actions confirm my suspicion that the policy is not backed up by theory or evidence: but is ideological. Misanthropic even.

On the 27th February, Dave Ramsden responded to Ms Baldwin’s attack in the FT.

In arcane language, he made clear that the Bank of England will ignore her committee; that it has raised rates (and will probably keep them high, no matter the impact on the economy). That it is selling sovereign and corporate bonds, and, yes, making losses on the APF.

Who will carry the can for those losses? The answer reader, is you the taxpayer. According to the design of the APF, the Treasury pays for the cost of losses, deliberately imposed by the Bank of England’s technocrats.

Ms Baldwin and her committee concluded therefore, that QT meant the BoE was messing with fiscal policy by demanding higher repayments from HMTreasury on those higher rated APF reserves.

Unfortunately, the UK Treasury refuses to publish details of the “indemnity” it pays to the Bank of England. But Ms Baldwin and her committee think they know what these losses amount to:

The committee heard during the inquiry that there may be around £130bn of losses incurred over the lifetime of QE and QT, to be paid for by the government. …. it clearly highlights a risk of extra strain on Treasury coffers.

£130 billion is a lot of ‘potatoes’ as Damon Runyon would have expressed it.

British central bankers are using the tool of the APF to mess with fiscal policy - just before the Conservative Chancellor (and the Institute for Fiscal Studies) announces a new Budget, and warns “there is no money”.

How bankers keep profiting from monetary policy

But it gets worse than that.

If you want to understand how at a time of inflation, a cost-of-living crisis, and an over-indebted economy, private commercial banks can make extraordinary profits - then look to the Bank of England, Quantitative Tightening and the Asset Purchase Facility (APF). As Gabor explains:

the APF’s winners are private banks, whose pre-tax profits in the first nine months of 2023 reached £41bn, roughly the amount received from the APF and nearly double on the previous year,

The Bank of England remains unmoved and remote.

On the 27th February, Dave Ramsden shot back at Ms Baldwin and the Treasury Select Committee. Covering himself in the shield of “independence” - from the people if not private banks - he admitted that:

Our approach to this issue differs from other central banks, notably the Federal Reserve, which aims to maintain its QE portfolio at a level that will back an ‘ample’ level of reserves.

The Monetary Policy Committee of the Bank of England, he wrote in what I judge as spiteful terms

could unwind the APF fully, if it judged necessary for policy reasons…

With these words, war was declared. Watch this space for news from the battlefield.

A really interesting article that asks some very important questions. There is no doubt that QE was a funnel for profits for the banks and no doubt the QT will be equally valuable. The banks’ balance sheet looks increasingly healthy and bonuses are rising once more. It is the poorest in society who pay for this largesse through the debasement of money that leads to rising inflation. Why don’t we windfall tax on banks? For fear of an exodus- why do we not renationalise the Bank of England, because politicians can’t be trusted to do the right things ahead of elections. Who holds the power in this relationship- certainly not society. If we continue on in this vain inequality will continue to rise along with social and political instability. No one wants to own a currency like that.

"The Bank of England paid for the purchase of those sovereign and corporate bonds with ‘high powered money’ which took the form of reserves deposited in commercial banks."

Just for the clarity of the non-economists that I hope are reading this excellent blog, (I presume) this means deposited in the reserve accounts that commercial banks hold at the BoE (?) , not a deposit at the commercial bank itself.