Yesterday, 5th July, 2022 the Bank of England published its Financial Stability Report. Without batting an eyelid the authors introduced it this way…

The economic outlook for the UK and globally has deteriorated materially

..as if the deterioration was an autonomous process and had nothing to do with central bank policies.

They go on to remind us (as if we need reminding) that:

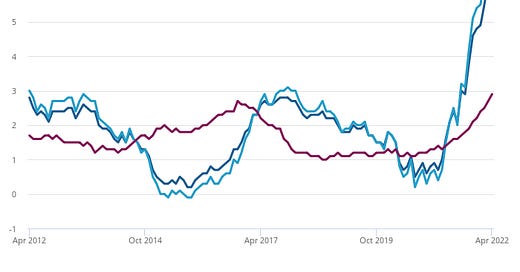

Like other central banks around the world, we have increased interest rates to help slow down price increases.

Do they mean this kind of slowdown?

This is followed by the apparent surprise that, thanks to autonomous forces of nature, “markets”

have been volatile and financing conditions have tightened.

Not “we have tightened conditions and that has led to market volatility” Or “markets have been volatile and financing conditions have tightened because we have tightened.”

Given the Bank has tightened conditions its staff are keen for us to understand that

tighter financing conditions will make it harder for households and businesses to repay or refinance debt.

Had they not thought this would happen - when they tightened?

To be fair the full quote is:

..higher prices, weaker growth and tighter financing conditions…

will make it harder for households and businesses to repay or refinance debt. As a result the Old Lady of Threadneedle street fully expects

households and business to become more stretched over coming months. They will also be more vulnerable to further shocks.

Thanks M’lady.

'Well!' said the [workhouse] matron, leaning her elbow on the table, and looking reflectively at the fire; 'I'm sure we have all on us a great deal to be grateful for! A great deal, if we did but know it. Ah!'

From Oliver Twist by Charles Dickens, Chapter 23.