In the run-up to the Great Financial Crisis I repeatedly warned that high real central bank rates of interest were like ‘a dagger aimed at a bubble of debt’. As I wrote on the Open Democracy site in 2003 in a piece titled The Coming First World Debt Crisis:

When interest rates begin to rise again, when debt costs soar both for corporates and households, when defaults and bankruptcies increase more rapidly than now, then the tipping point will be reached.

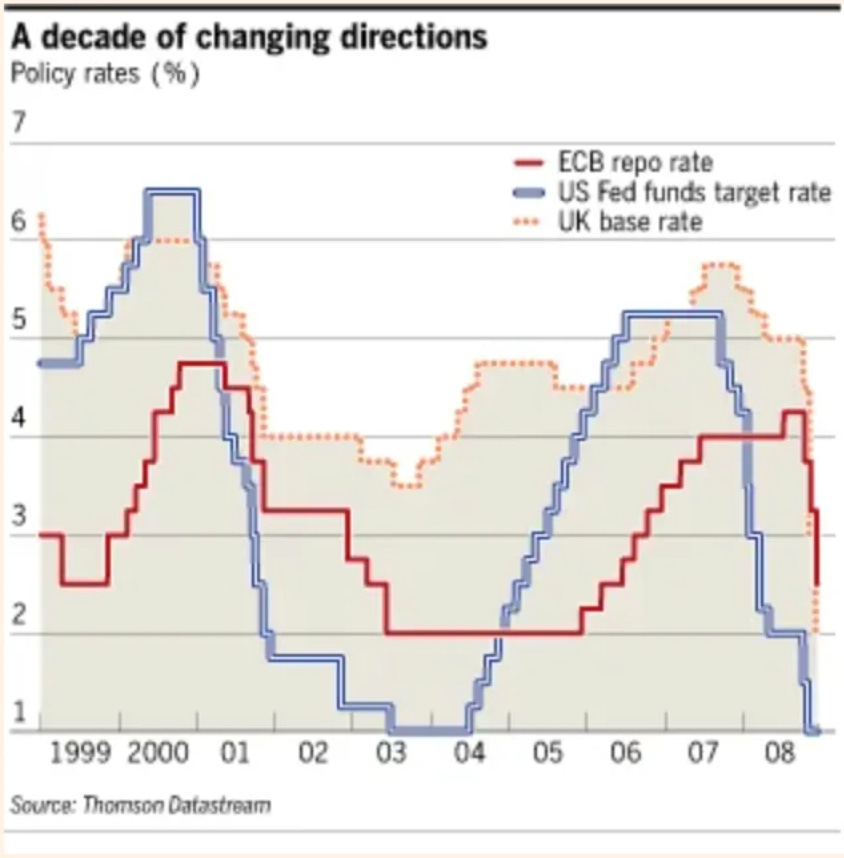

The point about the impact of higher interest rates is well illustrated by the above FT chart published after the GFC.

The Federal Reserve and the Bank of England began hiking rates in 2004. Alan (‘the Maestro’) Greenspan and the Federal Open Market Committee hiked aggressively each quarter. They did so until the dagger burst the bubble of debt in August 2007.

I was reminded of their decisions by a chart posted by the Bank of England this last week. The Bank, led by an overtly political governor, Andrew Bailey, began hiking in December, 2021 and since then Monetary Policy Committee members have hiked higher and faster than the Federal Reserve between 2004-2007.

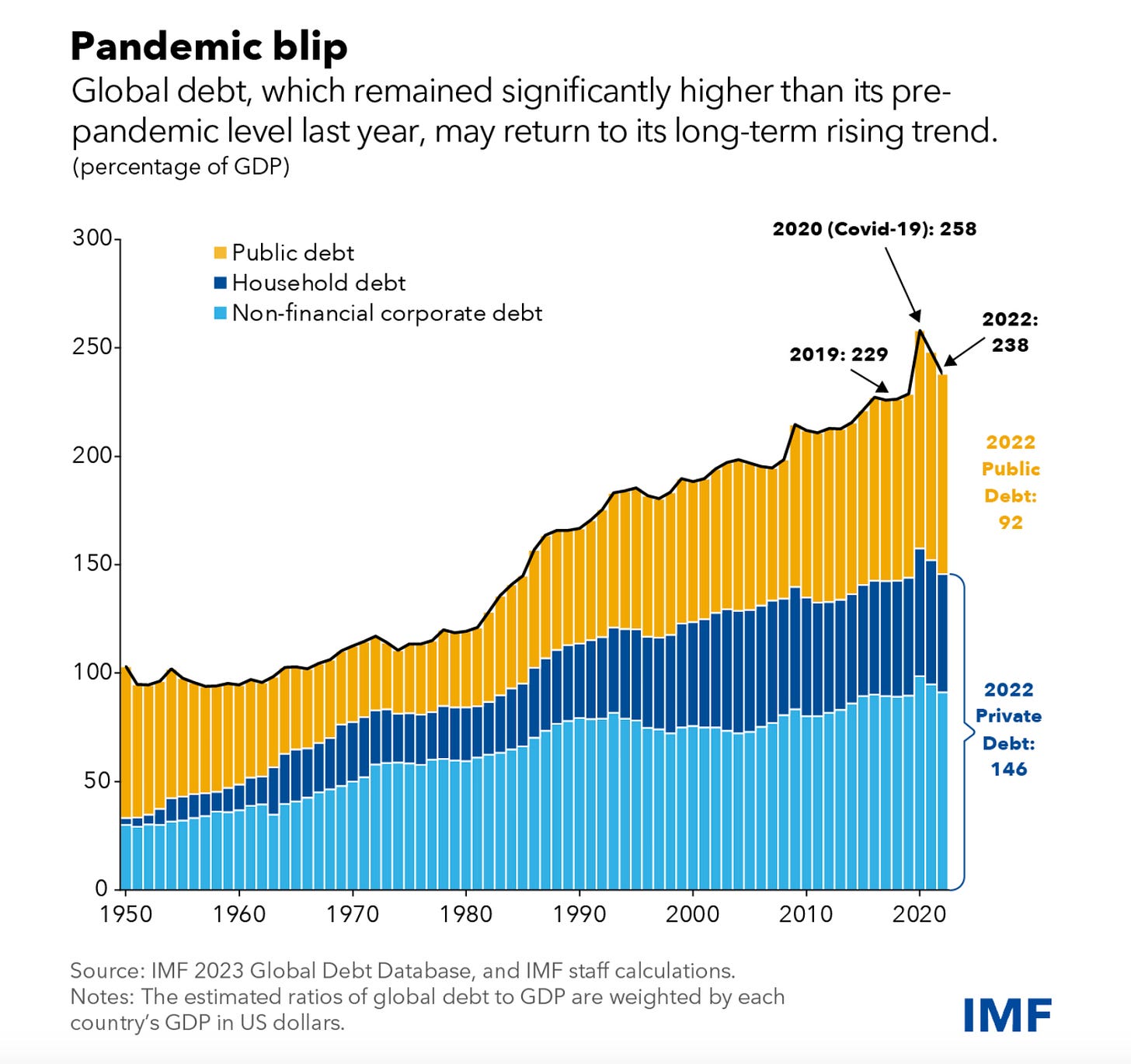

Now we know that levels of public and private debt as a share of global income (GDP) were high in 2007 when the Great Financial Crisis broke. Back then, public debt was 61% of global GDP; private debt was 134 % of GDP; and the total of both public and private debt was 193% of GDP.

We also know that debt is global. High UK rates impact debtors from afar. Many US and Australian-based so-called ‘Private Equity’ firms have, since the GFC, dumped large amounts of debt on UK companies, including Thames Water, ASDA, Morrisons, the AA and Liverpool football club.

It took just four years for the dagger of high real rates of interest to burst the 2007 debt bubble.

Since then, and going into the pandemic, volumes of both public and private debt have expanded according to the IMF.

Today, global private and public debt is near 250% of global income.

The Bank of England began the latest round of interest rate hikes in December, 2021. Subsequent hikes have been more rapid and more brutal than the Fed’s hikes over three years to 2007.

December, 2024 will mark three years since the Bank of England began raising rates.

Who knows what will happen then?

Given recent history, it might be wise to tighten your financial seatbelts.

but the pirvate debt/gdp in the US seems much lower compare to the 08 period

With all due humility my recognition that retail sale is the single universally as in aggregatively participated in/macro-economic point in the entire economic process, and thus is the perfect place to implement a monetary policy utilizing accounting that has resolving macro-economic effects on inflation, purchasing power and demand, and beneficial social, psychological and even spiritual effects as well...is worth something other than a non-Nobel prize in economics.

Considering that retail sale has been going on hundreds of millions of times every day right under economist's noses for centuries, Its also proof that thinking/abstracting, although an excellent way to identify problems, lacks sufficient direct observation to discover solutions...which is a signature of wisdom.