Will the US bond market blow up the Global Casino?

The dangers of the United States Treasury as a low-grade ‘collateral factory’

Will another failure of the shadow banking system blow up what I call the Global Casino?

And what will be the impact on households, firms and governments?

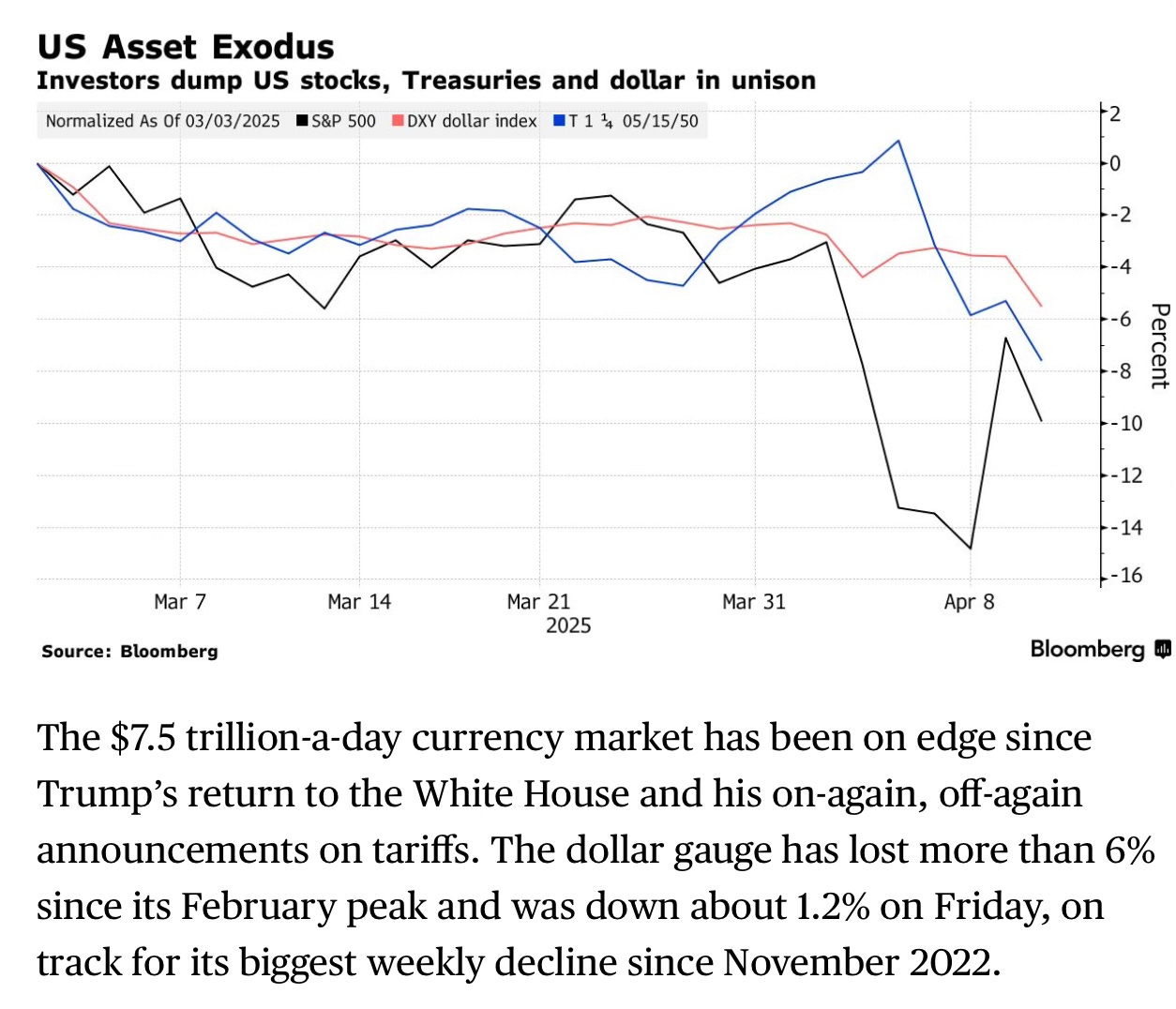

The US bond market is tanking as the Bloomberg chart below shows. We need to stop talking trade, and start talking US Treasuries.

Trump has aimed a wrecking ball at the global financial system

Everyone is talking trade. Trade imbalances, trade tariffs and trade tensions. Trade it turns out, is truly scary. Trade wars lead to real wars.

The instigator of those wars is the President of the United States. But the ‘Don’ is guilty of something more dangerous than the disruption of the global trading system.

He is also threatening the stability of the global financial system.

The Global Casino and the Shadow Banking system

The Global Casino (the title of my forthcoming book) as I have long argued, is the remote, unregulated space where gamblers (financiers and financial institutions) go to speculate big time. They include hedge funds, private equity firms and asset management companies - but also pension funds.

Central bankers have not only tolerated the existence of the Casino, and declined to regulate it properly; they have periodically bailed-out its gamblers and dealers - more or less unconditionally. They did so in 2007-9, but also in March, 2020 when COVID19 disrupted global financial markets.

The Casino no longer relies on Main Street banks for credit or for holding their savings. Operators like Blackrock and Blackstone, having globalised, and thanks to capital mobility, now do business and move capital effortlessly across national boundaries, and around the world. They hold huge quantities of the world’s savings. Those savings cannot safely be deposited in a Main St bank, as the guarantees against losses provided by governments are limited to about $250,000.

Globalised financial institutions (like asset management funds, private equity, hedge funds) have therefore moved into the financial equivalent of the stratosphere, and have set up a ‘shadow banking’ system.

In total the shadow banking or ‘repo’ system - defined as the Non-Bank Financial Intermediation (NBFI) system by the Financial Stability Board - manages more than $230 trillion dollars of the world’s savings.

Within the shadow banking system, the Casino depends heavily on public assets for collateral. The most important and safest of these are US Treasury Bills (bonds).

Collateral is used as a guarantee and comfort for lenders - including asset management funds and pension funds.

Borrowers - hedge funds, private equity firms and other speculators - use the collateral to leverage (borrow) additional funds from other players in the Casino. (Sometimes they use the same collateral repeatedly. Imagine if homeowners could use their mortgages in that way?)

Lenders that hold cash or savings, exchange collateral for cash - often on a short-term, overnight basis.

Instead of charging interest on the loan, lenders repurchase the collateral (hence the ‘repo’ market) and retain a slice - a ‘haircut’ - of the loan when the cash is repaid, as payment of interest on the loan. In other words, the borrower pays back slightly more to the lender, than was lent.

The most valuable collateral used in the ’shadow banking’ system is the government debt of OECD countries - their state and taxpayer-backed ‘promises to pay’.

The safest of all collateral has been the debt - Treasury bills or promises to pay - of the United States Treasury.

As Professor Daniela Gabor has argued - the US, like the UK and the EU- is a ‘collateral factory’ for the globalised private, financial system.

Public debt (government bonds) is vital ‘plumbing’ (to mix up all my metaphors) for the effective operation of the globalised, private financial system.

Speculators rely heavily on that public debt for lending and borrowing purposes and for the creation of ‘credit’ in the ‘shadow banking’ sector.

Donald Trump and the US ‘collateral factory’

Today confidence in the supposedly safest collateral produced by the United States ‘factory’ - the US Treasury - is fading fast.

Investors and speculators, unnerved by Trump’s recklessness and by his administration’s flagrant disregard for the rule of law, are selling up their US ‘collateral’. By dumping more Treasury bills on the bond market they are causing the price of bonds to fall.

Because of the way the bond market works, that means the yield (roughly equivalent to the rate of interest) on American bonds is rising. Those rising rates of interest serve as a basis for fixing mortgages and interest rates in the wider economy.

Rising interest rates is bad news for heavily indebted governments, firms and households.

But it is particularly dangerous for speculators that have borrowed heavily for the purposes of ahem…. speculation within the shadow banking system.

This week traders have engaged in a mind-numbing, chain-long ’trade’ described by some as ‘basis trading’. You probably don’t need to know how it works, but in case you do, the journalists at the FT’s Alphaville page explained it thus:

They sell Treasury futures and buy Treasury bonds to hedge themselves, capturing an almost risk-free spread of a few basis points….

Let’s say you put down $10mn for Treasuries and sell an equal value of futures. You can then use the Treasuries as collateral for, say, $9.9mn of short-term loans in the repo market. Then you buy another $9.9mn of Treasuries, sell an equivalent amount of Treasury futures, and the repeat the process again and again and again.

Are US Treasuries becoming ‘risky assets’?

Traders are under pressure because to make these gambles they have leveraged huge borrowing against finite quantities of collateral - US Treasury bills - that are now declining in value. Their lenders are not happy, and are demanding that additional collateral be stumped up, or debts repaid in full.

That puts traders under pressure to sell bonds and raise cash.

Others, unnerved by the activities of what has been described as the ‘crime syndicate’ in the White House, are flogging their US Treasury bonds because they don’t trust Trump and his repeated threats to fire the governor of the Federal Reserve. AND because the value of the bond is declining… Better to cash out and buy safer assets elsewhere.

As China holds a large amount of Treasuries, Donald Trump’s contempt for the country, his attacks on the ‘free’ trading arrangements of the WTO China was invited to join back in 2001 might persuade the Chinese government to sell off its US Treasury bills, accelerating the decline in the asset’s value.

Right now, the price of US Treasury bills is falling, and yields are rising. Treasuries - as the Bloomberg website explains - are suddenly trading as ‘risky assets’ - not safe collateral.

The question is this: when will the falling value of public debt used as collateral, blow up the heavily indebted shadow banking system? Again?

And how will another failure of the shadow banking system impact on households, firms and governments?

We need to start talking US Treasuries.

The sooner the better

Its so incredibly obvious that we need to much better regulate Finance/Financial Speculators so their "innovations" don't endanger everyone and everything.

The daily chaos wrought by the chaos merchant Trump is indeed aggravating and anxity evoking. We can protest, we can fantasize that Seal Team 6 will rise up when we really need them and deal with it or we can muster the willingness and ability to break through the modern intellectual shortcomings of (RAPO) Reductionist Analysis of Problems Only by learning from the historical record of paradigm changes that have always utilized the superlative intellectual method of the Integration of Opposites that Synthesize and Solve (IOSS) AKA Wisdom.

As I lke to say Science is wonderful, necessary and delicious…and it exists entirely within the digestive tract of Wisdom.The Chinese will continue to rise so long as they maintain their more practical stance toward Finance/Money. They haven’t yet recognized that applying the new monetary paradigm of Direct and Reciprocal Gifting at the strategic point of retail sale, but if they do the rest of the world will have to awaken to it as well or become less and less stable and prosperous. And if the US recognized it the Chinese etc. would have to adopt the new paradigm as well. Historically, everything adapts to a new paradigm…not the other way around. Why? Because new paradigms are true permanently progressive solutions not just accurate analysis of problems only and at best palliative/temporary/soon gamed reforms.